Portfolio Management Policy

Investment Target

DHR focuses on investing in logistics, residential, retail, and hotel properties (“Core Assets”).

DHR is also able to invest in other real estate asset classes such as office buildings (“Other Assets”). Investment target includes real estate under development and real estate to be developed by DHR. If the investment target is land, the buildings (including the ones to be developed) on the land shall be referenced to determine the asset class.

In principle, the investment ratio by asset class shall be as follows.

■ Core Assets

■ Other Assets

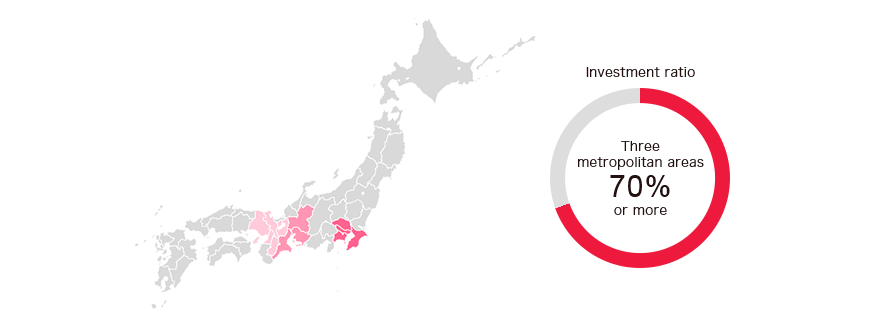

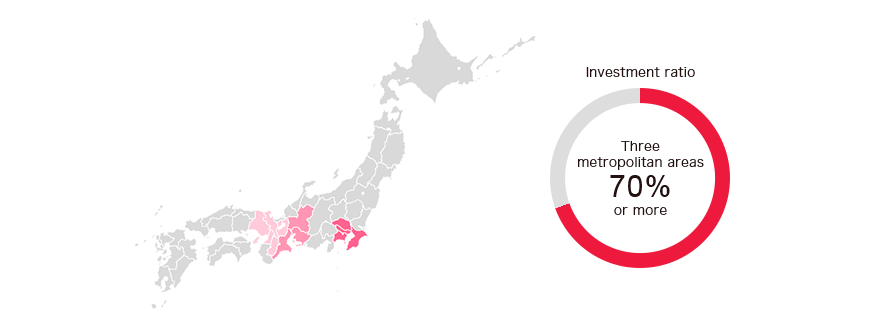

Investment Area

Investments are mainly focused in the three major metropolitan areas.

Investment amount per property

Investment standards for each asset type

Logistics properties

1. Categories

DHR invests in logistics properties in the following two categories.

2. Evaluation criteria and selection standards

DHR assesses properties on their location and other features, including whether they allow for efficient logistics and rapid adoption to market trends within the supply chain of procurement and production to sale and consumption, and invests in properties with a high level of competitiveness and stable income over the medium to long term.

DHR mainly invests in high-performance logistics properties (logistics properties located in areas DHR considers especially suited to logistics, and with facilities and specifications that meet DHR’s competitiveness criteria).

Residential properties

1. Categories

DHR invests in residential properties in the following two categories.

2. Evaluation criteria and selection standards

DHR invests in properties that will provide stable income and growth potential. DHR determines such properties by comprehensively assessing, among other things, the demand for rental property in the local area, the properties’ competitiveness and the sustainability of competitiveness in the future, the competitiveness of the property in the market area, adequacy of the contracted rent, and the status of nearby competing properties.

Retail properties

1. Categories

DHR invests in retail properties in the following three categories.

| Note: |

Enclosed malls are shopping malls that contain all stores in a single building around an air-conditioned mall center, while open malls are open-air shopping malls, including malls covered by a canopy top, that connect stores outside of a building. |

2. Evaluation criteria and selection standards

DHR invests in properties that will provide stable income and growth potential. DHR determines such properties by comprehensively assessing, among other things, the properties’ competitiveness and the sustainability of competitiveness in the future, stability and growth of the market area, competitiveness of the property in the market area, creditworthiness of tenants, adequacy of the contracted rent and the potential for opening a store near competing properties.

DHR mainly invests in specialty retail complexes (commercial properties which DHR believes are in a favorable location as a market area, with specialty store as core tenants whose products and services are broadly recognized by consumers in the relevant region, and with tenant businesses of categories and sizes well suited to the consumer characteristics and purchasing power of the region. Such properties house relevant specialty stores and may be a part of larger retail complexes that are integrated with multiple commercial facilities in the surrounding area.).

Hotel properties

1. Categories

DHR does not categorize the hotels in which it invests.

2. Evaluation criteria and selection standards

DHR invests in properties that will provide stable income and growth potential. DHR determines such properties by comprehensively assessing, among other things, the properties’ competitiveness and the sustainability of competitiveness in the future, stability and growth of the location area, creditworthiness of tenants, and adequacy of the contracted rent.

| Note: |

“ADR” is the average daily rate per guestroom, which is calculated by dividing total guestroom revenue by the number of guestrooms sold. |

Other Assets

Considering the fact that Other Assets have various types and that investment criteria and standards will vary in accordance with the different types of Other Assets, specific evaluation criteria and selection standards are not set for each type; investments to each of those properties will be decided upon comprehensive consideration of the regional characteristics arising from location-specific features, ease of securing alternative tenants, overall versatility of facilities, etc.