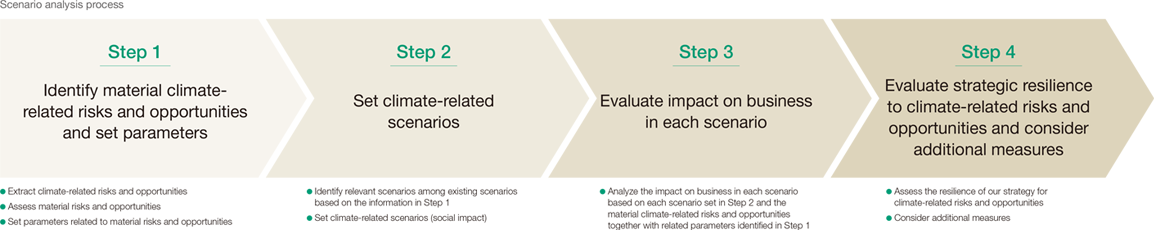

Scenario Analysis

We evaluate impact on business under several scenarios and conduct scenario analysis according to the following steps to assess strategic resilience to climate-related risks and opportunities.

Step 1 Identify material climate-related risks and opportunities and set parameters

We have identified the risks and opportunities for DHR in the future due to unusual weather caused by climate change and increasing social demands for climate change measures.

| Category | Type | Contents | |

|---|---|---|---|

| Risks | Transition risk | Policy and regulation |

Increased costs due to introduction of a carbon tax and expansion of emissions trading system, increased procurement costs for construction materials |

| Technology | Increased installation and maintenance costs due to installation of solar power generation equipment | ||

| Market | Decrease in rent income due to changes in tenant demand (declining needs for properties not responding to climate change) | ||

| Reputation | Increased funding costs due to growing stakeholder concerns or negative feedback by delayed response to climate change risks | ||

| Physical risk | Acute | Loss of business opportunities and increased repair costs and non-life insurance premiums due to inundation of buildings caused by increased torrential rain, typhoons / floods, landslides and storms | |

| Chronic | Increased utility charges due to rising average temperature | ||

| Opportunities | Products and services | Increase in rent income (high occupancy, high rent) by providing low-carbon emission equipment and services to tenants | |

Step 2 Set climate-related scenarios

The scenarios on climate change referenced to formulate our own climate-related scenarios are outlined below.

| Category | Summary of scenario | Main reference scenarios |

|---|---|---|

| Below 2°C scenario |

The scenario that assumes policies and regulations to realize a carbon-free society are implemented and the global warming from pre-industrial levels will stay below 2°C.While the transition risk is high, the physical risk is low compared to the 4°C scenario. |

|

| 4°C scenario |

The scenario that assumes announced goals such as national goals under the Paris Agreement will be achieved.No new policies or regulations will be introduced, and global energy-derived CO2 emissions will continue to increase. |

|

Step 3Evaluate impact on business in each scenario

Step 4Evaluate strategic resilience to climate-related risks and opportunities and consider additional measures

Assuming 2030, we analyzed the impact of climate-related risks and opportunities on the business of DHR and formulated countermeasures and resilience.

| Category | Summary of scenario analysis results | Impact on business (Note) | Response / Resilience of DHR | ||

|---|---|---|---|---|---|

| Below 2°C scenario |

4°C scenario |

||||

| Transition risk | Policy and regulation |

Indirect costs increase related to GHG emissions in business activities due to introduction of a carbon tax | ¥35 million | ¥29 million |

|

| Service purchase costs indirectly increase related to GHG emissions in repairs and renovation work due to introduction of a carbon tax | ¥94 million | ¥42 million | Same as above | ||

| Technology | Installation and maintenance costs increase due to installation of solar power generation equipment | ¥798 million | ¥798 million |

|

|

| Market | Rent income decreases if the acquisition of environmental certification does not proceed as planned | ¥914 million | ¥914 million |

|

|

| Reputation | Investment unit prices fall and funding costs increase due to delays in ESG compliance | ¥48 million | ¥48 million |

|

|

| Physical risk | Acute | Building repair costs increase due to increased natural disasters such as floods | ¥427 million | ¥854 million |

|

| Rent income decreases due to increased risk of flooding of buildings | ¥42 million to ¥1,000 million | ¥84 million to ¥2,000 million | Same as above | ||

| Non-life insurance premiums increase due to increased risk of water damage | ¥22 million | ¥45 million | Same as above | ||

| Chronic | Water charges and power charges for tenants increase due to rising average temperature |

|

|

|

|

- The figures shown are the annual amount of impact estimated by the Asset Manager based on the past results and other factors with reference to the parameters general disclosed; therefore, accuracy of the figures are not guaranteed.

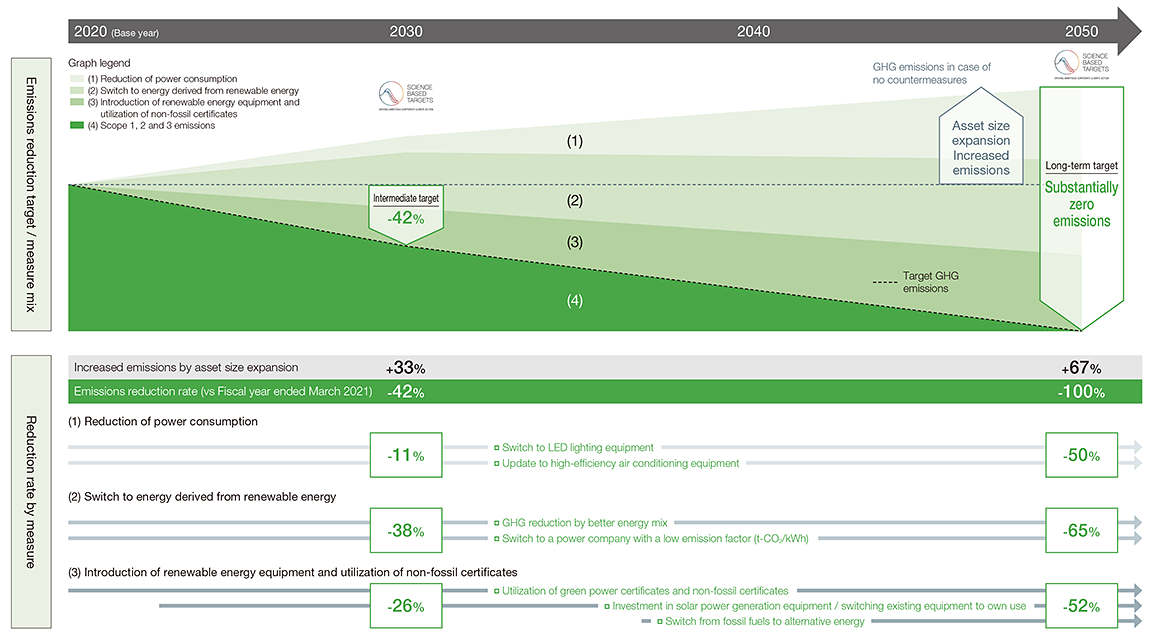

Roadmap for Reduction of Emissions and Achievement of Targets Certified by SBTi

DHR has set long-term targets of reducing total GHG emissions by 42% in the fiscal year ending March 2031 compared to the fiscal year ended March 2021 and net zero in the fiscal year ending March 2051 and formulated a roadmap that includes reduction rates by measure to achieve the goals.