Policy and Basic Approach

In recent years, climatic disasters, thought to be caused by climate change, are occurring globally and in all regions of Japan.To mitigate the effects of these events, the parties of the UNFCCC adopted the Paris Agreement—an international treaty aiming to achieve net zero GHG emissions—at the 21st UN Climate Change Conference (COP21) in 2015.In October 2020, the Japanese government declared that Japan would realize carbon neutrality by 2050, and in October 2021, revised its target for the fiscal year 2030 to an ambitious 46% reduction in GHG emissions compared to the fiscal year 2013. Companies and organizations now face the crucial task of actively shifting to renewable energy sources.

At COP27 held in Egypt in November 2022, the parties of the UNFCCC voiced the world’s unwavering commitment to reducing GHG emissions to achieve the 1.5°C target.

Supporting these trends, DHR has set targets for achieving net zero GHG emissions by the fiscal year ending March 2051, becoming the first J-REIT to receive certification from the Science Based Targets initiative (SBTi) that these targets are consistent with the levels required by the Paris Agreement and are based on scientific evidence.

Support for the TCFD Recommendations and Joining the TCFD Consortium

The Asset Manager has shown its support for the Task Force on Climate-related Financial Disclosures (TCFD) recommendations and has joined the TCFD Consortium, an organization consisting of domestic companies supporting the TCFD recommendations.

About TCFD

TCFD is an international initiative established by the Financial Stability Board (FSB) at the request of the G20 to examine how climate-related information should be disclosed and how financial institutions should respond. The TCFD publishes recommendations for companies to identify and disclose their “Governance,” “Strategy,” “Risk Management” and “Metrics and Targets” with respect to climate change-related risks and opportunities.

About TCFD Consortium

The TCFD Consortium was established as an organization to promote initiatives in which domestic companies that support the TCFD recommendations, financial institutions, etc. work together, and to discuss initiatives that will lead to effective information disclosure by companies and appropriate investment decisions by financial institutions, etc. based on the disclosed information.

First J-REIT to Be Certified by SBTi

DHR set targets for reducing GHG emissions by the fiscal year ending March 2031 and became the first J-REIT to acquire certification for its emission targets from SBTi, which certified that the targets are science-based targets consistent with the standards required by the Paris Agreement.

About SBT

The Paris Agreement aims to keep the global average temperature well below 2°C above pre-industrial levels and pursue efforts to limit global warming to 1.5°C. Science Based Targets (“SBT”) refer to GHG emissions reduction targets set by companies with a target year of 5 to 15 years ahead, which is consistent with the level required by the Paris Agreement. SBTi is an international initiative, which certifies companies that set the SBT and jointly run by the CDP, the United Nations Global Compact (UNGC), the World Resources Institute (WRI) and the World Wide Fund for Nature (WWF).

KPIs and Main Initiatives

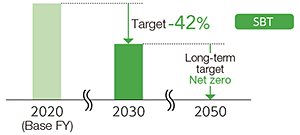

| Item | Coverage | Base year | Target year | Target |

|---|---|---|---|---|

| GHG emissions (Scope 1 and 2) |

All properties | 2020 | 2030 |

Reduce total emissions by 42%

SBTi certification |

| GHG emissions (Scope 3) |

Properties with data available | 2020 | 2030 |

Calculate and reduce total emissions SBTi certification |

| GHG emissions (value chain) |

All properties | 2020 | 2050 |

Net zero SBTi certification |

Information Disclosure Based on TCFD Recommendations

- The Asset Manager supports TCFD recommendations and promotes risk management and initiatives related to climate change.

- Information disclosure is based on the amended TCFD recommendations and new guidance in October 2021.

| Item | Contents | |

|---|---|---|

| Governance |

|

|

| Strategy |

|

|

| Risk Management |

|

|

| Metrics and Targets |

|

|