Policy and Basic Approach

The Asset Manager has established the following governance-related guidelines in its internal Compliance Manual.

- The Asset Manager is committed to thorough compliance as a fundamental management principle based on the realization that trust is its greatest asset and a keen awareness that compliance deficiencies can impair trust and, in turn, even undermine its management foundation.

- Recognizing the importance of its societal mission and responsibilities in the national economy as an asset manager that manages investment corporations’ assets, the Asset Manager will ensure compliance proactively and unremittingly.

- By putting compliance into practice, the Asset Manager will contribute to the sound development of the economy and society, thereby elevating our reputation among investors and broadly gaining societal trust.

Executive Directors and Supervisory Directors of DHR

(1 (one) Executive Director and 2 (two) Supervisory Directors)

Female director ratio: 33 %

Average tenure of 3.7 years

As of March 31, 2023

Criteria / Reasons for Election

The selection of candidates is based on the premise that they are not disqualified per the reasons set forth in various laws and regulations such as the Investment Trusts Act (Article 98 and Article 100 of the Investment Trusts Act and Article 244 of the Ordinance for Enforcement of the Investment Trusts Act). They are elected by resolution of the general meeting of unitholders based on the reasons for election below. The Board of Directors is currently comprised of persons with no special interest with DHR. In addition, the Supervisory Directors of DHR are “independent officers” who are not in conflict with the criteria for independence from Executive Officers and the Asset Manager as stipulated in the Investment Trusts Act.

| Title and post | Name | Reason for election | Attendance at meetings of the Board of Directors(Note) | Number of investment units held |

|---|---|---|---|---|

| Executive Director | Toshiharu Asada | Toshiharu Asada has a wealth of operational experience and knowledge not only in general finance but also in real estate. We have elected him as Executive Director based on his appropriate judgment pertaining to execution of business operations as well as his character and knowledge. | 100% (15 / 15) |

0 units (Note 2) |

| Supervisory Director | Hiroshi Ishikawa | Hiroshi Ishikawa is familiar with laws and regulations as an attorney-at-law. In addition, he has experience as an outside director at a listed company. We have elected him as Supervisory Director because we determined that he possesses the good character and knowledge necessary to supervise the execution of duties by Executive Director as a Supervisory Director and to perform his duties as a member of the DHR Board of Directors. | 100% (15 / 15) |

0 units (Note 2) |

| Supervisory Director | Junko Kogayu | Junko Kogayu is familiar with accounting and tax matters as a certified public accountant and tax accountant. In addition, she has experience as an outside director at a listed company. We have elected her as Supervisory Director because we determined that she possesses the good character and knowledge necessary to supervise the execution of duties by Executive Director as a Supervisory Director and to perform her duties as a member of the DHR Board of Directors. | 100% (15 / 15) |

0 units (Note 2) |

- Attendance at meetings of the Board of Directors held during the fiscal periods ended August 31, 2021 and February 28, 2022 is indicated in terms of number and percentage.

- In accordance with DHR’s rules on the management of insider trading, etc., DHR’s officers are not allowed to buy or sell units issued by DHR.

DHR Directors: Status and Remuneration

The maximum monthly compensation for an Executive Director shall be ¥800,000, and that for a Supervisory Director shall be ¥350,000. The Board of Directors will determine the compensation amounts deemed reasonable in light of trends in general commodity prices, wages, and the like.

The criteria for payment of compensation of Executive Directors and Supervisory Directors are stipulated in the regulations, and any changes must be approved at a Unitholders’ Meeting.

| Title and post Name |

Independent officer (Note 1) | Experience & expertise (Note 2) | Main qualifications | Attendance at Board of Directors meetings in the 33rd & 34th periods | |||||

|---|---|---|---|---|---|---|---|---|---|

| Corporate Management | Real Estate | Legal & Compliance | Risk Management | Finance & Accounting | Sustainability | ||||

|

Executive Director Toshiharu Asada (Male) |

✓ | ✓ | ✓ | ✓ | ✓ | - | ¥4,920 thousand (including ¥120 thousand in sustainability index-linked fees) |

||

|

Supervisory Director Hiroshi Ishikawa (Male) |

✓ | ✓ | ✓ | ✓ | ✓ | Attorney | ¥4,200 thousand | ||

|

Supervisory Director Junko Kogayu (Female) |

✓ | ✓ | ✓ | ✓ | ✓ | Certified public accountant, tax accountant | ¥4,200 thousand | ||

- The Supervisory Directors of DHR are “independent officers” who are not in conflict with the criteria for independence from Executive Officers and the Asset Manager as stipulated in the Investment Trusts Act.

- The table shows the leading skills at which each Director excels compared to others, not necessarily all of their knowledge and experience.

- The Executive Director and Supervisory Directors do not hold investment units of DHR under their own or another person’s name.

- In regard to the liability set forth in Article 115-6, Paragraph 1 of the Investment Trusts Act, if a Director has acted in good faith and has not been grossly negligent in performing their duties, and it is deemed necessary considering the underlying facts, the status of the Director’s performance of their duties, and other such circumstances, DHR may exempt them from liability to the extent allowed by law by resolution of the Board of Directors.

Sustainability Index-linked Fees

Remuneration for the Executive Director of DHR and for directors of the Asset Manager are now linked to sustainability indices, including GHG emissions reduction ratio, GRESB Rating and CDP Score.

Additionally, “ESG initiatives in response to societal demands” was added as a performance evaluation criterion for the employees of the Asset Manager.

Compensation of the Audit Firm

The amount of compensation for the Independent Auditor shall be determined by the Board of Directors, and the maximum shall be ¥25,000 thousand per fiscal period subject to audit.

| Name | Description of compensation | Total amount of compensation | |

|---|---|---|---|

| Fiscal period ended August 31, 2022 |

Fiscal period ended February 28, 2023 |

||

| Ernst & Young ShinNihon LLC (Note 2) | Compensation based on auditing duties | ¥17,500 thousand | ¥17,500 thousand |

| Compensation based on non-auditing duties | ¥3,600 thousand (Note 3) | ¥2,000 thousand (Note 3) | |

| Total | ¥21,100 thousand | ¥19,500 thousand | |

- Dismissal or non-reappointment of the Independent Auditor shall be discussed at DHR’s Board of Directors pursuant to the provisions of the Investment Trusts Act for dismissal, taking into full account all relevant factors for non-reappointment such as the quality of audits and compensation for audits.

- The continuous auditing period is from June 2005 to the present.

- Compensation is for preparation of comfort letters.

Compensation of the Asset Manager

Compensation of the Asset Manager

| Item | Total amount of compensation | |

|---|---|---|

| Fiscal period ended August 31, 2022 | Fiscal period ended February 28, 2023 | |

| Management fee 1 (Asset-linked fee) |

¥823,177 thousand | ¥810,540 thousand |

| Management fee 2 (Profit-linked compensation) |

¥1,028,106 thousand | ¥1,029,022 thousand |

| Management fee 3 (Sustainability Index-linked fee) |

¥70,390 thousand | ¥69,382 thousand |

| Acquisition/disposition fees | - | - |

| Total | ¥1,921,674 thousand | ¥1,908,944 thousand |

Sustainability Index-linked Fees

In November 2021, DHR introduced a provision to fluctuate the amount of asset management fees to the Asset Manager in conjunction with the sustainability indices as the first initiative in J-REITs for the purpose of increasing unitholder value by encouraging the reduction of GHG emissions of DHR properties and enhancing the external evaluations of its sustainability initiatives.

This is to increase or decrease the amount of asset management fees based on the sum of indexed GHG emissions reduction ratio, GRESB Rating and CDP Score multiplied by the total assets of DHR, and is aimed at strengthening the commitment to solving ESG issues and improving governance.

Furthermore, remuneration for Executive Director of DHR and remuneration for directors of the Asset Manager are now linked to sustainability indices including GHG emissions reduction ratio, GRESB Rating and CDP Score.

| Management fee 1 (Asset-linked fee) | Total assets × 0.18% (Note 1) |

|---|---|

| Management fee 2 (Profit-linked compensation) | NOI × 4.5% (Note 1) |

| Management fee 3 (Sustainability Index-linked fee) | (1) Total assets × 0.008 (Note 2) × GHG emissions reduction (Table 1) (2) Total assets × 0.002 (Note 3) × GRESB Rating (Table 2) (3) Total assets × 0.002 (Note 4) × CDP Score (Table 3) |

- The upper limit is 0.4% for Management fee 1 and 5.0% for Management fee 2.

- The upper limit is 0.012% for the index (1) of Management fee 3.

- The upper limit is 0.004% for the index (2) of Management fee 3.

- The upper limit is 0.004% for the index (3) of Management fee 3.

Table 1

| Multiple | 1 - GHG Emissions Reduction Ratio |

|---|

- GHG emissions reduction ratio: ((b) - (a)) / (a)

- GHG emissions intensity in fiscal year ended March 2018 (April 2017 - March 2018) 0.0556 (t-CO2/m2)

- GHG emissions intensity in the immediately preceding fiscal year (April - March) (t-CO2/m2)

Table 2

| GRESB Real Estate Assessment | ★ | ★★ | ★★★ | ★★★★ | ★★★★★ |

|---|---|---|---|---|---|

| Multiple | 0.8 | 0.9 | 1.0 | 1.1 | 1.2 |

- Multiple is determined based on the assessment in the immediately preceding fiscal period.

Table 3

| CDP Climate Change Program Score | D- | D | C- | C | B- | B | A- | A |

|---|---|---|---|---|---|---|---|---|

| Multiple | 0.6 | 0.7 | 0.8 | 0.9 | 1.0 | 1.1 | 1.2 | 1.3 |

- Multiple is determined based on the assessment in the immediately preceding fiscal period.

Management Structure

| Compliance Committee | Members |

Chair: Compliance Officer Members: Full-time Directors, officers and employees designated by the President approved by the Chair, outside experts |

|---|---|---|

| Function and role | Deliberating and resolving on compliance in the context of operational and internal management | |

| Daiwa House REIT Investment Management Committee |

Members |

Chair: Head of Daiwa House REIT Division Members: Full-time Directors (except those in charge of the Private Fund Division), General Manager of the Investment Department, General Managers of the Fund Management Department and Asset Management Department of the Daiwa House REIT Division, officers and employees designated by the President approved by the Chair Observer: Compliance Officer |

| Function and role | Deliberating and resolving on the validity and other attributes of DHR’s asset management operations | |

| Sustainability Committee | Members |

Committee Head: President and CEO Operating office: General Manager, Sustainability Promotion Department Executing officer: Head of Daiwa House REIT Division, Head of Private Fund Division Members: All full-time Directors, Heads of Division, General Managers (excluding Compliance Officer) and other selected officers and employees Observers: Outside expert advisor, Compliance Officer |

| Function and role | Deliberations and approvals regarding sustainability-related policy and strategy development and execution of sustainability-related operations; reporting to the Board of Directors and the DHR Board of Directors as appropriate |

Outside Expert Advisor of the Sustainability Committee

The Asset Manager has appointed an outside expert advisor who has extensive knowledge and experience in sustainability to the Sustainability Committee.

| Name | Sex | Main concurrent positions |

|---|---|---|

| Emi Matsukawa | Female personnel |

Representative Director, General Incorporated Association Collective Action Outside Advisor, PRONEXUS Inc. Senior Manager, General Incorporated Association CDP Worldwide-Japan |

Policy and Management Structure for Addressing Conflict-of-interest Transactions

The Daiwa House Group could significantly influence the decision-making of the Asset Manager and DHR. It is a close partner with the deepest understanding of the basic concepts of DHR. DHR recognizes that proper coordination with these companies is a means to carry out our asset management operations more effectively.

On the other hand, close relationships among companies are in fact conducive to acts that potentially pose conflicts of interest. Recognizing that preventing conflicts of interest with the Daiwa House Group and other interested parties is one of the top compliance priorities in the asset management operations, DHR and the Asset Manager have established the following control system.

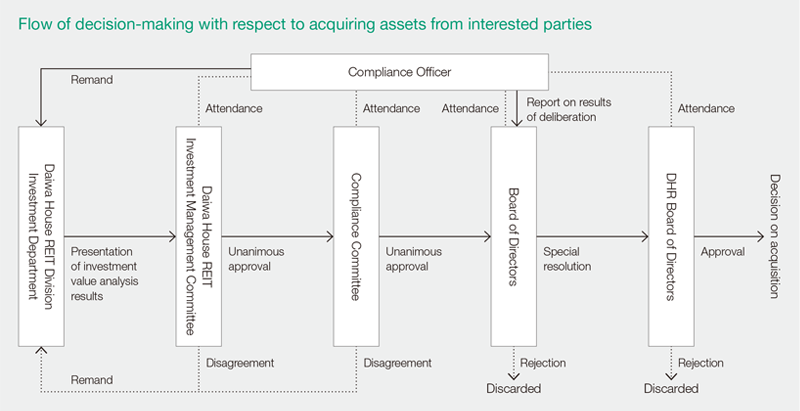

Under the regulations of the Asset Manager, when conducting transactions involving the acquisition, disposition, leasing, or outsourced management of portfolio, entering brokerage agreements related to these transactions or placing an order for construction thereof between an interested party more broadly defined than what is established by law and DHR, except when there are separate provisions for the transaction, the rule is that unanimous approval must be obtained at the Asset Manager’s Daiwa House REIT Investment Management Committee and Compliance Committee and then a resolution by the Board of Directors before such a transaction can be executed.In addition, at DHR, approval must be obtained from the DHR Board of Directors, which is comprised of Directors who are not Directors or employees of the Asset Manager.When acquiring portfolio assets from an interested party, in principle, the maximum acquisition price shall be the appraisal value, and when selling portfolio assets to an interested party, in principle, the minimum selling price shall be the appraisal value. Furthermore, from the standpoint of transparency, when DHR conducts certain transactions with interested parties, information is promptly disclosed in an appropriate manner in accordance with the regulations of the Asset Manager and various provisions of applicable laws.

In addition, the Asset Manager has appointed an attorney at law familiar with the Financial Instruments and Exchange Act who possesses a solid track record as an outside expert member of the Compliance Committee. At meetings of the Compliance Committee, the outside expert member provides various on-point opinions and advice from the standpoint of a neutral expert, including in discussions on transactions carrying the risk of a conflict of interest, thereby contributing to fair and appropriate discussions, ensuring that customer interests are not unduly harmed.