Policy and Basic Approach

- Business value

(economic value) - ×

- Social value

(non-financial value) - =

- Maximization of unitholder value

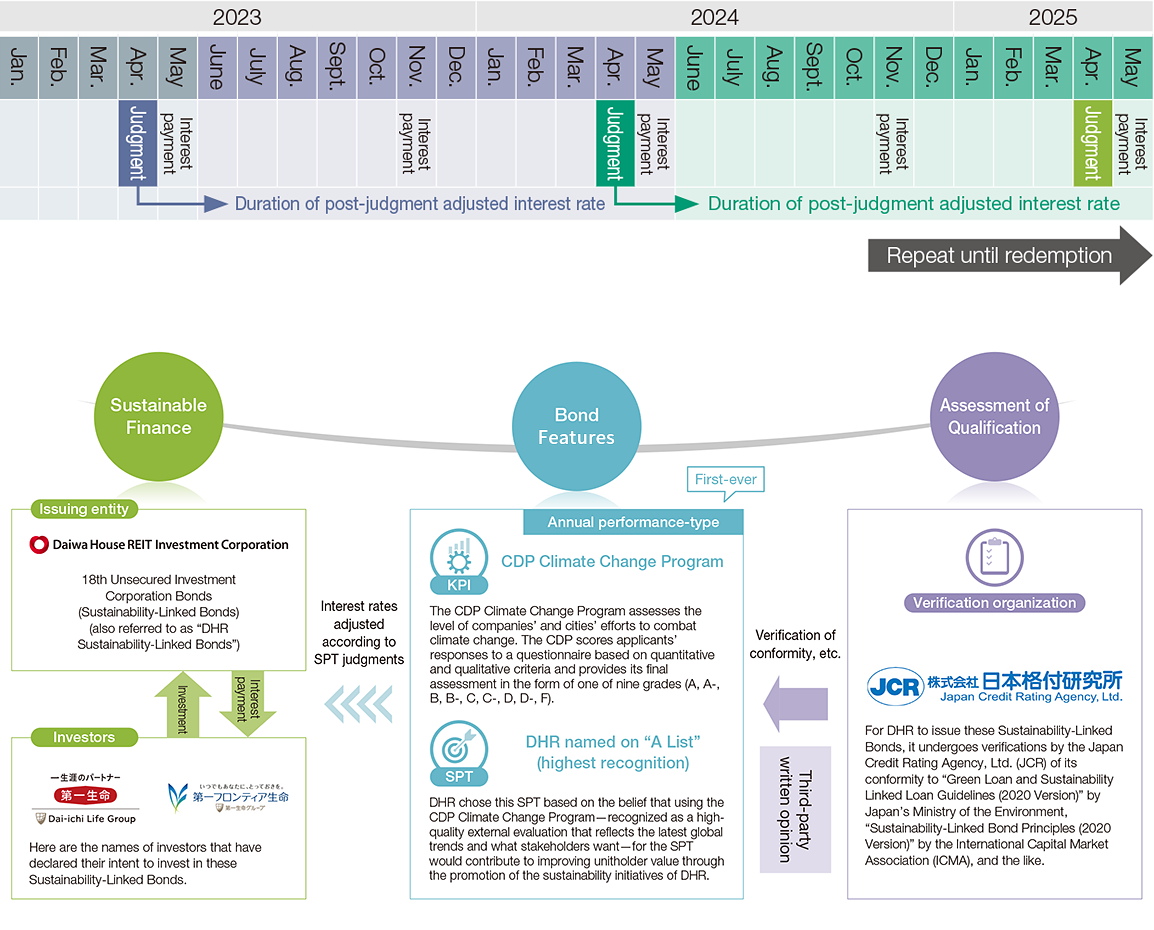

- Sustainability-Linked Bonds have conditions that depend on whether the prescribed sustainability target has been achieved

- They are a new initiative wherein the results of sustainability initiatives are reflected in the form of economic value, namely the bonds’ interest rate

- By achieving growth in both business and social value, these bonds will further advance the growth strategy of DHR—to maximize unitholder value

Overview of DHR Sustainability-Linked Bonds

Overview

| Name | 18th Unsecured Investment Corporation Bonds (Sustainability-Linked Bonds) (also referred to as “DHR Sustainability-Linked Bonds”) |

||||||||

|---|---|---|---|---|---|---|---|---|---|

| Issue date | May 25, 2022 | ||||||||

| Issue amount/Term | ¥4 billion/7 years | ||||||||

| SPT | DHR named on “A List” (highest recognition) in CDP Climate Change Program | ||||||||

| Interest rate |

Initial interest rate: 0.575% per annum (May 26, 2022–May 25, 2023) Interest rate after SPT assessment: Based on level of achievement as shown on the table below (on and after May 26, 2023)

|

- Sustainability Performance Target (SPT): A prescribed sustainability-related target.

Structure

Rate adjusted according to SPT judgment

Schedule of SPT judgments and adjustments to interest rates